Thanks to recent decisions by the GOP-controlled Congress and the Roberts Supreme Court, renewable energy (and energy efficiency) have been given a major boost. A new analysis suggests that this boost, particularly the extension of the solar and wind energy tax credits in the end-of-year budget deal, is large enough to wipe out the natural gas renaissance that had been recently brought on by cheap shale gas.

For decades, natural gas advocates have been advancing their fossil fuel as a necessary bridge to a renewable energy future. The argument has been that natural gas is a low-carbon fuel able to power our modern economy more cheaply and dependably than “intermittent” solar and wind. Indeed, the boom in low-cost fracked gas seemed to be proving the advocates right.

I myself was a (relatively) early booster of shale gas as a potential game changer for greenhouse gas mitigation seven years ago during the debate over the cost of the Waxman-Markey climate bill [see Game Changer, Part One: “There appears to be a lot more natural gas than previously thought” and Part Two: “Unconventional gas makes the 2020 climate targets so damn easy and cheap to meet”].

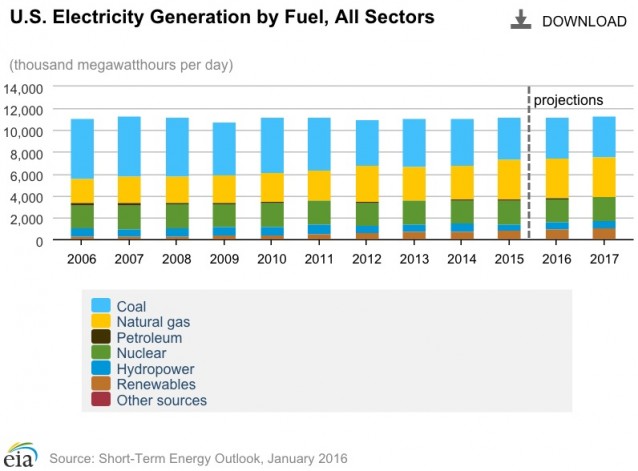

Yet in the past seven years, every one of those arguments has fallen apart — even as natural gas generation expanded (along with renewables), squeezing out coal power, as the Energy Information Administration chart below shows:

Note that U.S. generation has essentially been flat since 2007 and is forecast to remain flat. Bloomberg New Energy Finance’s “2015 Sustainable Energy in America Fact Book” points out “There has been an outright decoupling between electricity growth and economic growth.”

This decoupling is an unprecedented achievement in modern U.S. history, and one that deserves a post of his own. But it’s worth noting now that the recent Supreme Court decision in favor of so-called “demand response” — rewarding people for adjusting their power usage — puts energy efficiency and demand reduction on a level playing field with electricity generation. That means we are going to see a lot more efficiency and demand reduction in the future, since they are invariably the biggest and cheapest “new” sources of electricity by far.

So U.S. electricity demand growth is likely to continue to be minimal if not non-existent for the foreseeable future. And that means all new generation, such as renewables and natural gas, will simply replace existing power plants, particularly coal. That replacement is especially likely given the Clean Power Plan (CPP), which is a set of carbon pollution standards for power plants issued by the EPA in consultation with the public, industry, and states — standards the Supreme Court decided in 2007 the EPA is legally obligated to put in place once carbon pollution is found to be endangering public health, which it obviously is.

By law, states have to come up with implementation plans to meet the EPA standards. Fortunately, as former EPA chief Christine Todd Whitman told me last year, the CPP is “the most flexible thing” the EPA has ever done. It gives more options to states and industry to meet the new standards than any previous regulation, enabling them to use a wide variety of strategies to advance a wide variety of low carbon technologies, including renewables, natural gas, and energy efficiency.

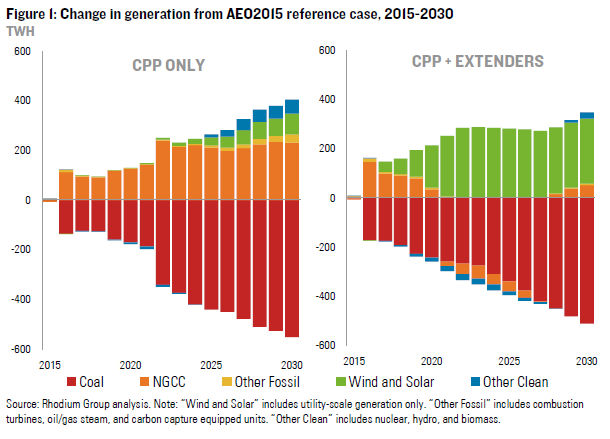

A new analysis from the Rhodium Group comes to this stunning conclusion about the impact of Congress’s recent decision to extend tax credits for wind and solar power:

Without the tax extenders, the least-cost CPP compliance pathway would be a shift from coal generation to Natural Gas Combined Cycle (NGCC) generation. The tax extenders fundamentally change the game. We expect wind and solar to cut off the surge of NGCC generation and become the technology of choice for the entire CPP compliance period.

The key point is that the tax extenders “change the compliance game by shifting the economics in renewables’ favor nearly a decade earlier than they would under the CPP alone.” And so rather than natural gas being a bridge fuel to a renewable future, “The renewables industry now has a bridge to the CPP,” thanks to the budget deal.

Here is how the analysis breaks down what will happen now versus what was going to happen without the renewable tax credit extensions — based on a modified version of the model used by the US Energy Information Administration (EIA) to produce their Annual Energy Outlook (AEO):

Absent the budget deal, compliance with EPA’s clean power plan would have largely been met by natural gas generation replacing coal (chart on left). But thanks to the extension of the renewable energy tax credits, gas will play a far more limited role and renewables will replace coal (chart on right).

Ultimately, the International Energy Agency (among others) have explained that to avoid catastrophic global warming, the entire world must be powered primarily by renewable sources of energy by 2050, as I discussed in Part One.

The only remaining question is whether variable renewable power sources can be incorporated into the grid in a reliable and low-cost manner — both in the near-term at moderate levels and in the long term at very high levels. As I’ll discuss in the final part of this series, the answer is yes in both cases, especially thanks to the Supreme Court’s demand response ruling.